When designing new reporting tools, the focus often lies on adjusting the current version. In this article we take a step back and address more fundamental questions: Why does a bank produce client reports? Which topics and subject matters are elaborated, what message do we want to convey? And how can we achieve that?

Accountability – the number one reason for investment reports

First and foremost, the client seeks accountability from the financial institution. It is noteworthy to point out that there are two main matters to account for: on the one hand, the current financial situation that provides information about future stability and on the other hand, past decisions impacting the performance.

In this context, for the client accountability boils down to the following issue: is my money safe and will I have enough in the future? One aim of the investment report is to convey exactly that piece of information. However, investment reporting should take a step further, because depending on the answer to that question we expect different statements. If all is well, then we want to gain a sense of security and confidence. In the other case, we should be encouraged to act! Note that these findings generally hold true for any type of reporting.

Reassure or initiate an action?

Taking a closer look, we can distinguish between three levels in investment reporting in both a positive or a rather troubled situation.

If the financial situation is stable, the first statement should ease our fears. All is well, everything is safe. On the second level, the report should explain how this stable situation was achieved and lastly it should establish the evidence to trust in the institution.

If, on the other hand, the situation is not according to plan the function of the investment report is to alert us: Please pay attention to this issue. It should also analyze the situation and provide possible explanations. Ideally all this knowledge then animates to take corrective action.

Tools of the investment report

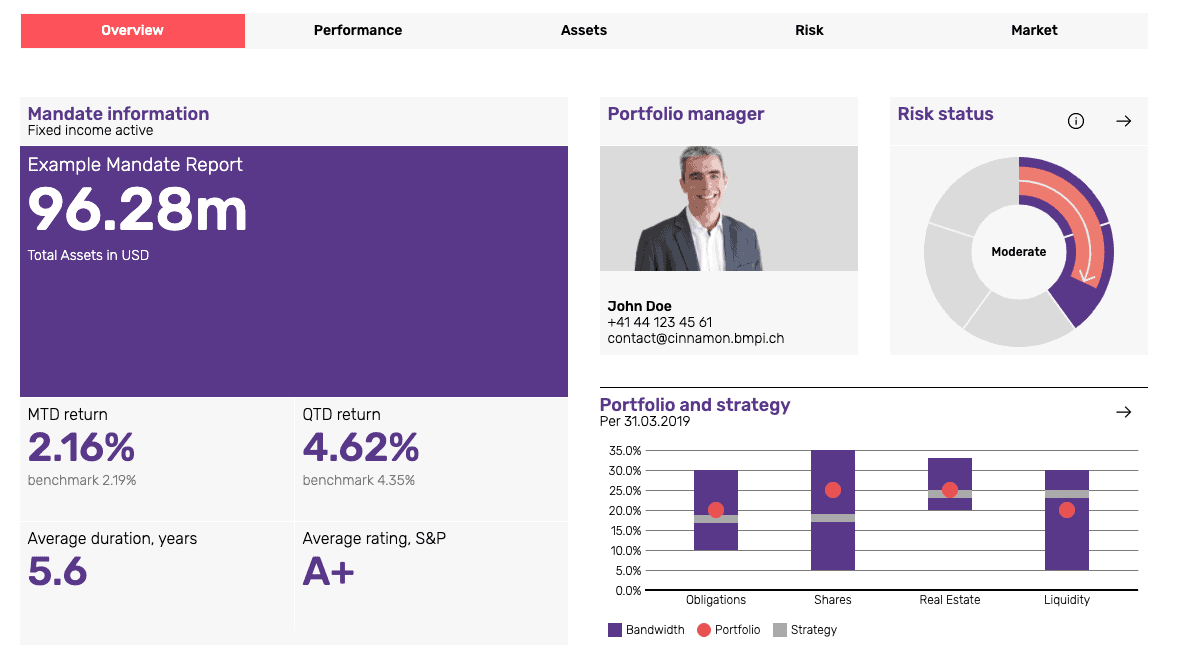

The standard toolkit of investment reports provides a multitude of possibilities to achieve the above-mentioned goals. To name but a few: the overall performance, check of the investment guidelines, position and transaction list, the portfolio attribution or a risk analysis. Each of these tools, presented in the report usually as a (table of) key figure(s) or a chart, serve a particular purpose – if this purpose cannot clearly be identified, the provided information usually tends to confuse the clients and its use should be questioned.

Do you provide the right investment report?

These shared thoughts also hold true for existing reporting systems. Therefore, it might be advisable to regularly evaluate a reporting system and ask: Does our report ensure the necessary information to our clients? Are we using the correct tools to make our argument sound? For a more detailed analysis check our Whitepaper (in German) or contact us directly.

—

You want to know more about Cinnamon Reporting?

- Discover our explanatory videos about zu Cinnamon Reporting.

- You can get additional information in our wiki about Cinnamon Reporting.

- Contact Marcus Brändle at marcus.braendle@bmpi.ch or +41 44 454 84 84 for a consultation.

Would you like to learn more about ESG reporting?

- Would you like to offer ESG reporting to your clients and prospects? Take advantage of our service. Find out more on our ESG website.

- What is the difference between the ESG Web Report and the ESG Print Report? View our ESG Web Report and our ESG Print Report.

- Contact Thomas Tscherrig at thomas.tscherrig@bmpi.ch or +41 44 454 84 84 for a consultation.

Get news on client reporting,

trends, white papers and more.

Subscribe to our blog articles.