Ever wondered about the nuances between client reporting and investment reporting? Dive into the distinctions: Client reporting involves recurrent financial communications directed from agents to clients, while investment reporting delves into recurring communication about accountable party’s investments. Unveil a new perspective on these essential financial practices, exploring how they differ in scope and purpose.

Client Reporting and Investment Reporting are often used interchangeably. In this blog post, we examine the difference between the two terms.

The Big Question: How Client Reporting differs from Investment Reporting

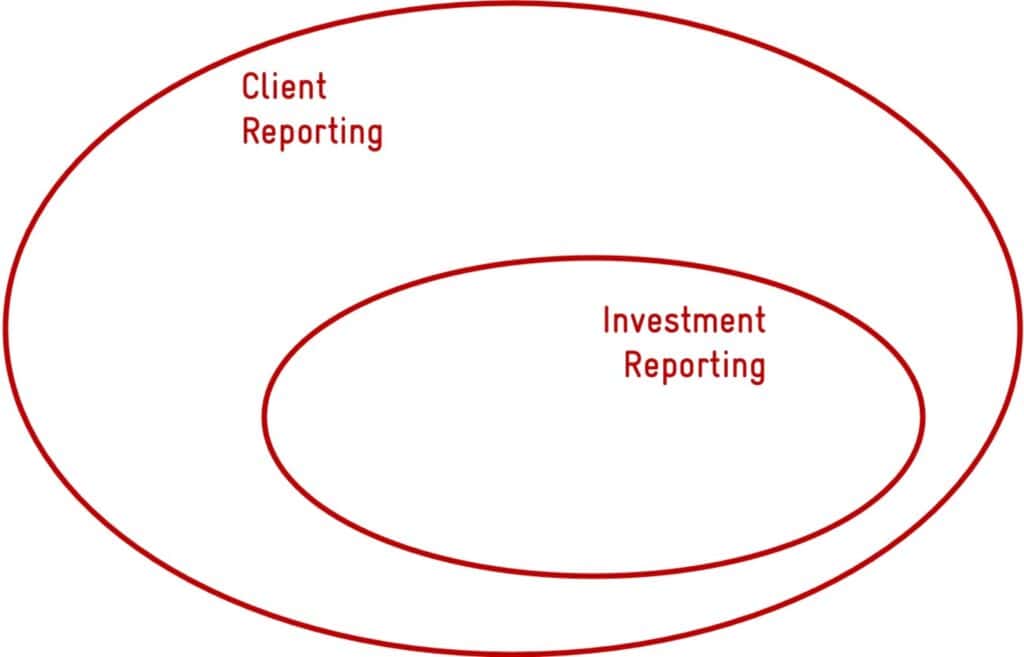

Our clients often ask us about the difference between client reporting and investment reporting. At least in finance, both terms seem to address the same kind of statements, and there is much confusion around. Even within our company, we still have vivid discussions around the words. One way of thinking is that client reporting is the broader term, including investment reporting, among other statements.

Digging deeper the difference between client reporting and investment reporting

First, we need to approach the topic by looking at the parties involved in reporting: There is always someone accountable for the whereabouts of and, often, the decisions about a financial asset. That party may or may not prepare the report themselves. In case they do not, then a separate report preparer creates the statement as an independent party. A perfect example would be a global custodian who reports all the assets independent of the accountable party. On the receiving end of reporting, there might not even be the asset owners but someone who acts on their behalf—for instance, the pensions fund’s board of directors who acts on behalf of their beneficiaries. We call the receiving party report consumer.

In total, we have three parties: the accountable party, the report preparer (who might be identical to the accountable party), and the report consumer.

Now we can define both terms, client reporting and investment reporting.

Client Reporting

Client reporting is any recurring communication from an agent to their clients about any financial matter. Notice that the agent is the report preparer and the client is the report consumer in this case. Furthermore, it is necessary to have recurring in the definition because we want to exclude one-off communication such as contract setups, brochures, or notifications (such as a change of relationship manager). An excellent example of a client report is the asset statement or, leaving investment as a topic, some billing report.

Investment Reporting

Investment reporting is any recurring communication from the report preparer to the report consumer about the accountable party’s investments. We can already see the difference emerge. While client reporting focuses on the relationship between the agent and their clients, investment reporting focuses on the investment itself. It does not say who is going to consume the report. For instance, asset managers might publish their fund fact sheets regularly without the fund investor even noticing or with the effect that non-investors read it (which would be rare in the area of client reporting). Also, investment reporting is always about investments, whereas client reporting includes non-investments too.

New Way of Thinking?

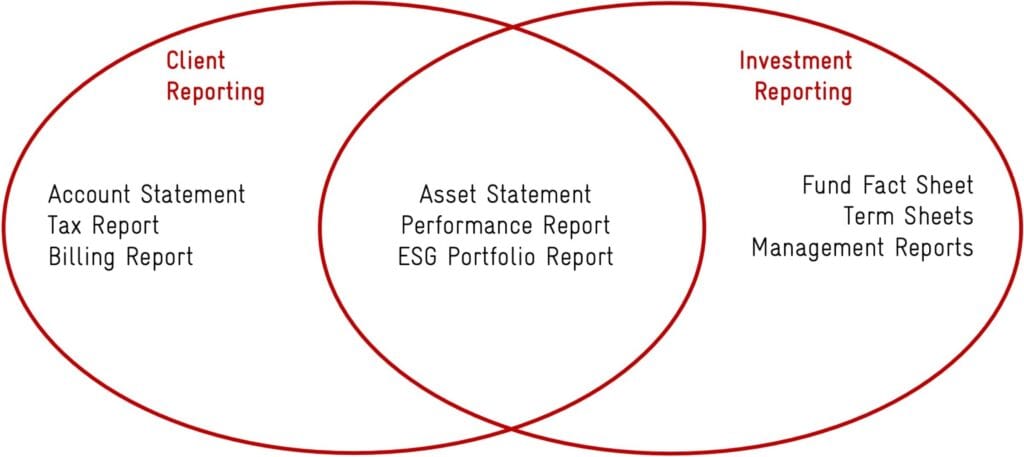

With these definitions in mind, we can draw a new picture:

You might object here and argue that investment reports have the investor in mind, who ultimately are clients too. Therefore, all investment reporting is also client reporting (the first picture).

We think that both pictures have their right to existence. Let us know which definition you find more attractive.

—

Sie möchten mehr über Cinnamon Reporting erfahren?

- Entdecken Sie unsere Erklärvideos zu Cinnamon Reporting.

- In unserem Wiki zu Cinnamon Reporting erhalten Sie weitere Informationen.

- Kontaktieren Sie Marcus Brändle unter marcus.braendle@bmpi.ch oder +41 44 454 84 84 für ein Beratungsgespräch.

Sie möchten mehr zu ESG-Reporting erfahren?

- Sie möchten Ihren Kunden und Prospects ein ESG-Reporting anbieten? Nutzen Sie unseren Service. Mehr dazu auf unserer ESG-Website.

- Was ist der Unterschied zwischen dem ESG-Webreport und dem ESG-Printreport? Sehen Sie sich unseren ESG-Webreport und unseren ESG-Printreport an.

- Kontaktieren Sie Thomas Tscherrig unter thomas.tscherrig@bmpi.ch oder +41 44 454 84 84 für ein Beratungsgespräch.

Erhalten Sie Neuigkeiten zu Client Reporting, Trends, White Papers und mehr.

Abonnieren Sie unsere Blogartikel.